Fee Payments In Online & Offline Education

Remitting fees is a major source of concern and frustration for students and parents alike. Fee payments are usually completed manually and frequently involve printing several paper documents such as payment acknowledgments, challans & payment slips. These are later submitted to the relevant academic authorities for confirmation and storage.

Paper-based procedures like these often result in misplaced or lost documents, errors in payment details that usually take too long to rectify, and mismanagement of documents at the institutional level.

Students typically bear the brunt of such instances – fees aren’t paid on time, and errors in payment details are carried over to the institutional database resulting in further problems, all of which ultimately affect students’ mental health and academic performance.

Additionally, with education increasingly being delivered online, paper-based fee payment methods are quickly becoming inconvenient and outdated.

Edtech businesses, who have been critical in pushing the boundaries of the education sector and digitizing numerous aspects of education, must now help educational institutions digitize other critical aspects of their functioning – chief among them being fee payments.

By integrating with enach based fee payment solutions, the Edtech sector can help schools & universities provide students with a digital and hassle-free method of paying fees securely and on time.

How Paper-based Fee Payments Can Go Wrong

Paper-based methods of fee payments are plagued with several drawbacks that affect both the student body and the productivity of educational institutions.

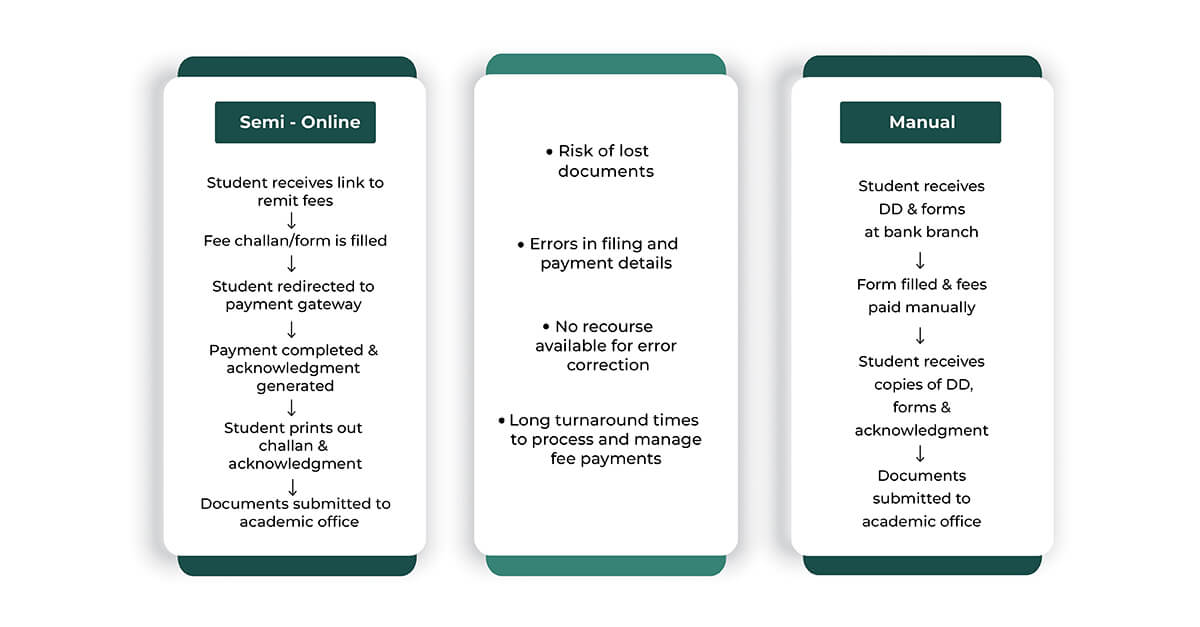

To examine why let’s look at a typical paper-based fee payment process.

Evidently, these methods of fee payment are rife with obstacles and problems –

-

-

Document loss & mismanagement

-

Paper documents are often liable to be lost or misplaced, resulting in delays in fee payments. Additionally, due to the nature of paper-based documents.

These also result in low productivity and further delays for academic office workers.

-

-

Occurrence of errors & a lack of avenues for recourse

-

Manual document processing leaves room for errors in populating forms and collecting data. According to surveys, knowledge workers have an error rates of 90% when processing documents.

Additionally, with manual fee payment systems, students often have no recourse when errors are found in their payment details and have to wait months to correct these errors.

-

-

Low efficiency & long turnaround times

-

Paper-based document management is among the most inefficient, with office workers reporting that half their time is spent finding the right document. Having to manually receive, store & manage paper records also results in long turnaround times for simple documentation tasks.

-

-

High expenses & paper costs

-

Organizations that rely on paper for major documentation activities overspend by 60-85%, according to surveys. These expenses include everything from paper storage, stationery, courier and management costs.

According to surveys, the average school generates 2800 sheets of paper per student on a daily basis- which translates to nearly USD 200,000 spent annually on just paper. Educational institutions need a digital means to collect and manage payments to reduce excessive paper costs.

With the rise of digital education, paper-based fee payments are untenable and need to be more scalable; educational institutions require an automated way to manage these recurring fee payments. So how can schools and colleges digitize this process?

eNACH-based Fee Payment – Automating Monthly & Annual Fee Remission

eNACH-based eMandate solutions are a secure, automated, and hassle-free way for educational institutions to collect and manage recurring fee payments.

eMandates are digital mandates that determine how much money is to be debited from an account periodically and then proceed to debit this money to a destination account (in this case, that of the educational institution).

The debit is preceded by an Additional Factor Authentication (AFA) – to ensure security, mandates are edited and managed on a single dashboard enabling, the accounts office of educational institutions and students to have better access to and control over fee payments.

eMandate solutions maintain a complete record of successful & failed payments and enable real-time mandate tracking. Additionally, eMandate solutions are integrated with students’ Aadhaar, debit card, or NetBanking details, allowing for secure authentication before any amount is debited.

Institutions that automate recurring payments using eNACH-based fee payment can expect to reap several benefits.

-

-

Reduced expenses & improved efficiency

-

Educational institutions can expect to reduce operational expenses by 60-85% by leveraging an eNACH-based fee payment system. Paper & storage costs are significantly reduced by going digital with recurring fee payments, and efficiency is improved by up to 70%.

-

-

No delays in payments & lowered turnaround time

-

eNACH eMandates ensure that payment schedules are automated, and fee payments are debited on time. Academic & accounts offices can lower turnaround time to process, document & manage payment details.

-

-

Hassle-free payments & a digital experience

-

Students and parents can attain a measure of relief by automating fee payments. The usual stressful procedures involving printing out documents, standing in queues, and waiting for confirmation are all done away with and replaced with the simple process of creating a mandate once and authenticating this mandate for fees to be debited.

Providing students and their parents with a hassle-free digital experience via eNACH-based fee payement will enable students to concentrate on academic and extracurricular activities rather than worrying about fees.

-

-

Strong controls over fee payments with visible audit trails

-

eNACH-based fee payments also provides students with strong and comprehensive user controls over fee payments.

Providers of automated payments services offer dashboards for the concerned parties to create, authenticate, track, edit & delete mandates online. All payment activities are also recorded & viewable, enabling easy audits.

The advantages of leveraging an eNACH-based fee payments system are numerous and educational institutions would do well to employ an automated payments solution to enable hassle-free digital fee payments.

Next, let’s look at how such a system would work in the context of fee payments.

eNACH-based Fee Payments – How They Work

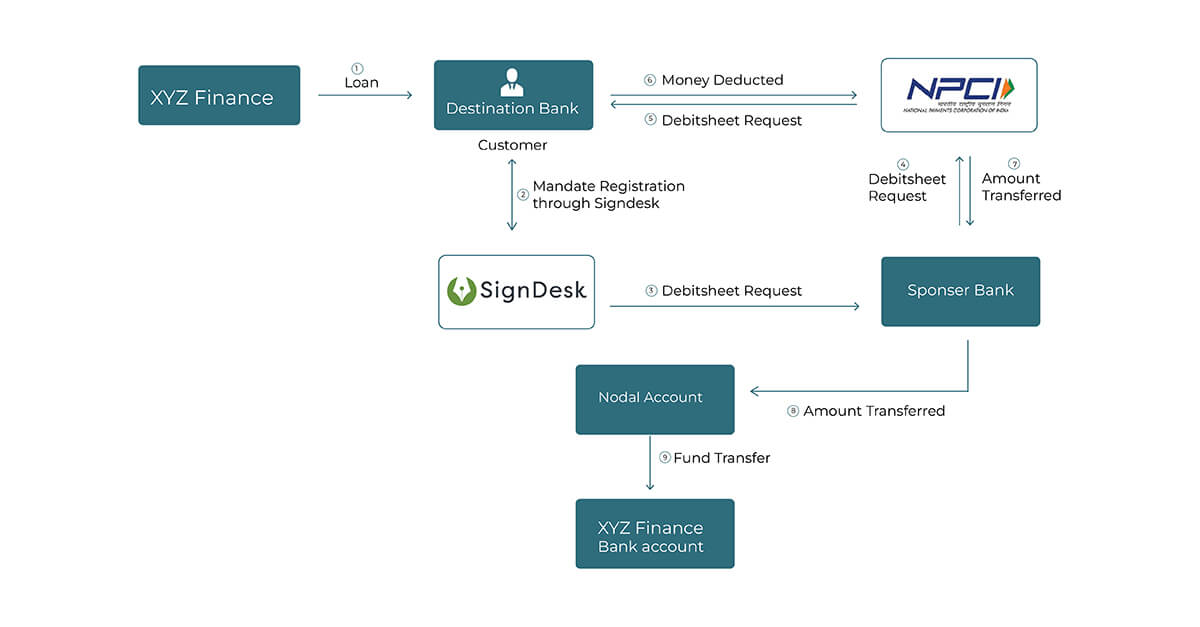

eMandate solutions for automated recurring payments bring together several stakeholders, including banks and regulatory bodies such as NPCI, to track, authenticate, and manage recurring transactions between entities.

SignDesk offers an NPCI-compliant eNACH eMandate solution currently being leveraged by several major banks and is a seasoned domain expert in this area.

The entities involved in SignDesk’s eMandate process are –

Sponsor Bank: The bank that acts as a bridge between SignDesk and NPCI.

Destination Bank: The bank where the customer has an account and has agreed to debit the money with recurring frequency.

Corporate/client Bank: The client bank that receives the credited amount.

The eMandate process involves the following steps:-

- The customer registers a mandate at their destination bank through SignDesk

- SignDesk sends a debit sheet request to the sponsor bank

- This debit sheet request is passed to the destination bank via NPCI

- The requisite amount is then debited from the destination bank to NPCI

- NPCI then transfers the amount to the sponsor bank

- The amount passes through a nodal account to the client bank

Here’s a bird’s eye view of this entire process.

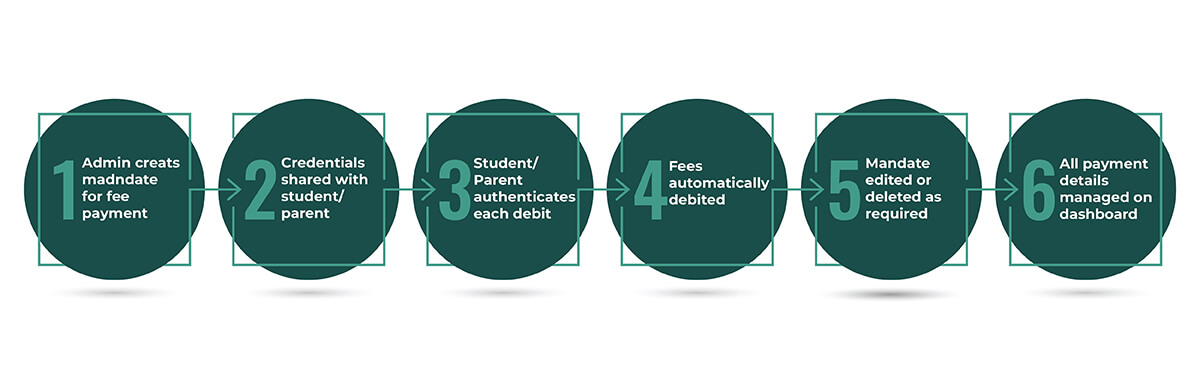

In the context of fee payments in educational institutions, this translates into a simple and expedited way for students to complete fee payments and for institutions to better manage these payments.

Here’s how eNACH-based fee payments works using SignDesk’s eNACH eMandate solution.

Why Edtech Needs To Integrate With eMandate Providers

Edtech is pushing the education sector past new frontiers with offerings that improve learning, lecture delivery, student-teacher interactions and the availability of premium study materials –

Edtech needs to focus on other equally important areas in the education sector.

Fee payments are an crucial aspect of the education sector and a constant source of frustration for students and inefficiency and mismanagement for educational institutions.

By integrating with enach based fee payment, Edtech businesses can offer schools and universities a simplified, secure, and expedited method to remit fees periodically.

Educational institutions need a better way to collect recurring payments and Edtech businesses need to make the requisite solutions available.

SignDesk – Paper-free Periodic Payments With eMandates

SignDesk is a GDPR-compliant and award-winning provider of compliance & document automation solutions for 350+ clients, including 60+ major banks.

Our solutions automate all the compliance aspects of any business’ documentation processes, including – customer onboarding, digital evidence creation, contract lifecycle management, and recurring payments –

We also ensure the highest & most stringent data security standards & protocols for client data across the board.

SignDesk’s AI-powered ID verification solution leverages OCR techniques for image data extraction, AI technology for real-time ID verification, and features for facial matching and ML-based fraud detection features. Our digital KYC verification solution has enabled several banks and major enterprises to reduce verification expenses by 60-85% and boost audit efficiency by nearly 60%. We were also awarded the Global Banking & Finance Review’s Best Onboarding solution in India for 2020.

SignDesk offers an eSign workflow solution with custom legally valid templates and a range of eSignatures, including electronic, DSC, Aadhaar & PAN-based signatures, and India’s most popular digital stamping solution in use by nearly 85% of all businesses.

We also offer an eNACH-based eMandate solution to automate recurring payments, with physical, Aadhaar & API-based mandates, and options to approve via eSign, debit card, and NetBanking.

Are you ready to automate your onboarding and documentation with AI-powered technology?

Book a free demo with us now!